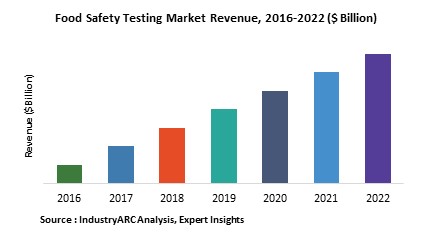

The global Food testing Market is estimated to surpass $7,688 million mark by 2023 growing at an estimated CAGR of more than 6.1% during 2018 to 2023. Globally demand of this market is expected to be driven by the increasing global food trade, rising microbial contamination cases, increasing instances of food mislabeling, changing government regulations. Growing foodborne diseases and increased retail chains have developed consciousness among the consumers, thus driving the growth of food safety testing market globally.

What is Food testing ?

Food testing is a procedure of food product verification in order to check safety and decrease risk of contamination which causes food borne illness. Food testing involves validation of food product contents as indicated on the labels. Food safety testing has been important factor for maintaining quality of food in terms of ingredients, taste and appearance. Food safety testing techniques such as microbial contamination and analysis on chemical contents says all aspects of safe food production, processing and delivering the product to the consumer. Food safety testing helps the companies in regulating allergenic components and pathogenic bacteria in food products that provides safe and healthy products to the consumers.

What are the major applications for Food testing ?

The various end user segments assessed include dairy products, food grains, meat & poultry, fruits & vegetables, processed foods, beverages and others. Food grains include grains of wheat, rice & others. These crops are contaminated due to the presence of pesticides, fungicides, and herbicides. These chemicals are used by farmers for better yields of the crop but the pesticide gets mixed with the grains which may cause health risk to people. So, food grain test is analyzed by many food industries to test the presence of harmful pesticides residue from food grains.

Processed foods are mainly those products which are canned, dehydrated or chemically prepared. Food processing uses chemical and mechanical technologies which removes the nutrients present in the food. Processed food contains many ingredients which can lead to health risks. Due to these factors food testing has become an important factor in processed foods and also nutritional & chemical analysis testing is done to analyze different toxic chemicals in the processed foods. Sea foods contain a number of bacterial illnesses and it arises due to the contamination of harmful chemicals and pathogens like E.coli, Vibrio, Salmonella, and listeria. These pathogens are not easily detected as they are present in low concentrations. But many food industries have started food testing methods like biological testing, authenticity testing and others that detects the pathogens.

Market Research and Market Trends of Food testing

- The Massachusetts institute of technology has developed a new technology that will offer cheaper & faster food testing technique. The new MIT test is based on a novel type of liquid droplet that can bind to bacterial proteins. This interaction, which can be identified by either the smart phone or naked eye, would provide a much faster and cheaper alternative to prevailing food safety tests. Present food safety testing often involves placing food samples in a culture dish to see whether harmful bacterial colonies form, but that process takes two to three days. Rapid techniques based on antibody-bacteria interactions or bacterial DNA amplification is costly and it needs some special instruments. So this technology could enable faster, inexpensive identification of contamination using a smart phone.

- The latest biosensoristic and chemosensoristic devices used for detection of contaminants in both environmental and food matrices, are portable and allow for rapid diagnostics. The optical and electrochemical bio/chemosensoristic devices are used as promising tools in on-site and real time applications for monitoring of food matrices. This will have huge impact on the food testing market in the near future.

- Multi-dimensional analytical separation methods combined with high resolution accurate mass spectrometers (HRMS) or hybrid ion mobility (HRMS) are the forthcoming trends for the food analysis labs, providing multi-target food contaminant analysis of hundreds of pesticides, natural toxins and persistent organic pollutants in one workflow. As food fraud is a major issue and this advanced equipment can do a great job when operated in the untargeted mode and provided with multivariate statistics in order to disclose any abnormal chemical compositions.

- Clear Labs, a genomic data platform has pulled $13 million in series B funding to build a next generation sequencing based micro biome test. Since it is tough for food manufacturers to know the origin of an infected batch before it goes out to the public, clear labs has found a solution where it applies the similar technology used in human clinical trials, but for food products to find these infected batches. The funding comes from Google ventures, tencent, Khosla ventures, and felicis ventures.

Who are the Major Players in Food testing Market ?

The companies referred in the market research report include the Agilent Technologies Inc. (U.S), Thermo fisher Scientific Inc. (U.S), Shimadzu Corporation (Japan), PerkinElmer Inc. (U.S), and 10 others.

What is our report scope?

The report incorporates in-depth assessment of the competitive landscape, product market sizing, product benchmarking, market trends, product developments, financial analysis, strategic analysis and so on to gauge the impact forces and potential opportunities of the market. Apart from this the report also includes Bruker Corporation (U.S), a study of major developments in the market such as product launches, agreements, acquisitions, collaborations, mergers and so on to comprehend the prevailing market dynamics at present and its impact during the forecast period 2018-2024.

All our reports are customizable to your company needs to a certain extent, we do provide 20 free consulting hours along with purchase of each report, and this will allow you to request any additional data to customize the report to your needs.

Key Takeaways from this Report

- Evaluate market potential through analyzing growth rates (CAGR %), Volume (Units) and Value ($M) data given at country level – for product types, end use applications and by different industry verticals.

- Understand the different dynamics influencing the market – key driving factors, challenges and hidden opportunities.

- Get in-depth insights on your competitor performance – market shares, strategies, financial benchmarking, product benchmarking, SWOT and more.

- Analyze the sales and distribution channels across key geographies to improve top-line revenues.

- Understand the industry supply chain with a deep-dive on the value augmentation at each step, in order to optimize value and bring efficiencies in your processes.

- Get a quick outlook on the market entropy – M&A’s, deals, partnerships, product launches of all key players for the past 4 years.

- Evaluate the supply-demand gaps, import-export statistics and regulatory landscape for more than top 20 countries globally for the market.

1. Food Safety Testing Market - Overview

1.1. Definitions and Scope

2. Food Safety Testing Market - Executive summary

2.1. Market Revenue, Market Size and Key Trends by Company

2.2. Key Trends by type of Application

2.3. Key Trends segmented by Geography

3. Food Safety Testing Market

3.1. Comparative analysis

3.1.1. Product Benchmarking - Top 10 companies

3.1.2. Top 5 Financials Analysis

3.1.3. Market Value split by Top 10 companies

3.1.4. Patent Analysis - Top 10 companies

3.1.5. Pricing Analysis

4. Food Safety Testing Market – Startup companies Scenario Premium

4.1. Top 10 startup company Analysis by

4.1.1. Investment

4.1.2. Revenue

4.1.3. Market Shares

4.1.4. Market Size and Application Analysis

4.1.5. Venture Capital and Funding Scenario

5. Food Safety Testing Market – Industry Market Entry Scenario Premium

5.1. Regulatory Framework Overview

5.2. New Business and Ease of Doing business index

5.3. Case studies of successful ventures

5.4. Customer Analysis – Top 10 companies

6. Food Safety Testing Market Forces

6.1. Drivers

6.2. Constraints

6.3. Challenges

6.4. Porters five force model

6.4.1. Bargaining power of suppliers

6.4.2. Bargaining powers of customers

6.4.3. Threat of new entrants

6.4.4. Rivalry among existing players

6.4.5. Threat of substitutes

7. Food Safety Testing Market - Strategic analysis

7.1. Value chain analysis

7.2. Opportunities analysis

7.3. Product life cycle

7.4. Suppliers and distributors Market Share

8. Food Safety Testing Market – By Testing Type (Market Size -$Million / $Billion)

8.1. Market Size and Market Share Analysis

8.2. Application Revenue and Trend Research

8.3. Product Segment Analysis

8.3.1. Introduction

8.3.2. Microbiology analysis

8.3.2.1. Pathogens

8.3.2.1.1. E.Coli

8.3.2.1.2. Salmonella

8.3.2.1.3. Campylobacter

8.3.2.1.4. Listeria

8.3.2.1.5. Other Pathogens

8.3.2.2. Non-Pathogens

8.3.3. Pesticides & Fertilizers

8.3.4. Allergen Analysis

8.3.5. Lipids, Fats & Oil analysis

8.3.6. Genetically Modified Organisms (GMO)

8.3.7. Toxins

8.3.8. Others

9. Food Safety Testing Market – By Testing Technology (Market Size -$Million / $Billion)

9.1. Polymerase chain reaction (PCR)

9.2. Nuclear Magnetic Resonance (NMR)

9.3. Immunoassay

9.4. Enzyme Linked Immunosorbent Assay

9.5. Chromatography

9.6. Mass Spectrometry

9.7. Microarrays

9.8. Irradiation

9.9. Others

10. Food Safety Testing – By End Use Industry(Market Size -$Million / $Billion)

10.1. Segment type Size and Market Share Analysis

10.2. Application Revenue and Trends by type of Application

10.3. Application Segment Analysis by Type

10.3.1. Introduction

10.3.2. Dairy products

10.3.3. Grains

10.3.4. Processed foods

10.3.5. Meat & poultry

10.3.6. Fruits & vegetables

10.3.7. Sea foods

10.3.8. Beverages

10.3.9. Others

11. Food Safety Testing - By Geography (Market Size -$Million / $Billion)

11.1. Food Safety Testing Market - North America Segment Research

11.2. North America Market Research (Million / $Billion)

11.2.1. Segment type Size and Market Size Analysis

11.2.2. Revenue and Trends

11.2.3. Application Revenue and Trends by type of Application

11.2.4. Company Revenue and Product Analysis

11.2.5. North America Product type and Application Market Size

11.2.5.1. U.S.

11.2.5.2. Canada

11.2.5.3. Mexico

11.2.5.4. Rest of North America

11.3. Food Safety Testing - South America Segment Research

11.4. South America Market Research (Market Size -$Million / $Billion)

11.4.1. Segment type Size and Market Size Analysis

11.4.2. Revenue and Trends

11.4.3. Application Revenue and Trends by type of Application

11.4.4. Company Revenue and Product Analysis

11.4.5. South America Product type and Application Market Size

11.4.5.1. Brazil

11.4.5.2. Venezuela

11.4.5.3. Argentina

11.4.5.4. Ecuador

11.4.5.5. Peru

11.4.5.6. Colombia

11.4.5.7. Costa Rica

11.4.5.8. Rest of South America

11.5. Food Safety Testing - Europe Segment Research

11.6. Europe Market Research (Market Size -$Million / $Billion)

11.6.1. Segment type Size and Market Size Analysis

11.6.2. Revenue and Trends

11.6.3. Application Revenue and Trends by type of Application

11.6.4. Company Revenue and Product Analysis

11.6.5. Europe Segment Product type and Application Market Size

11.6.5.1. U.K

11.6.5.2. Germany

11.6.5.3. Italy

11.6.5.4. France

11.6.5.5. Netherlands

11.6.5.6. Belgium

11.6.5.7. Spain

11.6.5.8. Denmark

11.6.5.9. Rest of Europe

11.7. Food Safety Testing – APAC Segment Research

11.8. APAC Market Research (Market Size -$Million / $Billion)

11.8.1. Segment type Size and Market Size Analysis

11.8.2. Revenue and Trends

11.8.3. Application Revenue and Trends by type of Application

11.8.4. Company Revenue and Product Analysis

11.8.5. APAC Segment – Product type and Application Market Size

11.8.5.1. China

11.8.5.2. Australia

11.8.5.3. Japan

11.8.5.4. South Korea

11.8.5.5. India

11.8.5.6. Taiwan

11.8.5.7. Malaysia

12. Food Safety Testing Market - Entropy

12.1. New product launches

12.2. M&A's, collaborations, JVs and partnerships

13. Food Safety Testing Market – Industry / Segment Competition landscape Premium

13.1. Market Share Analysis

13.1.1. Market Share by Country- Top companies

13.1.2. Market Share by Region- Top 10 companies

13.1.3. Market Share by type of Application – Top 10 companies

13.1.4. Market Share by type of Product / Product category- Top 10 companies

13.1.5. Market Share at global level- Top 10 companies

13.1.6. Best Practises for companies

14. Food Safety Testing Market – Key Company List by Country Premium

15. Food Safety Testing Market Company Analysis

15.1. Market Share, Company Revenue, Products, M&A, Developments

15.2. Agilent Technologies Inc

15.3. Thermo fisher Scientific Inc. (U.S)

15.4. Shimadzu Corporation (Japan)

15.5. PerkinElmer Inc. (U.S)

15.6. Company 5

15.7. Company 6

15.8. Company 7

15.9. Company 8

15.10. Company 9

15.11. Company 10

15.12. Company 11

15.13. Company 12

15.14. Company 13

15.15. Company 14 and more

"*Financials would be provided on a best efforts basis for private companies"

16. Food Safety Testing Market - Appendix

16.1. Abbreviations

16.2. Sources

17. Food Safety Testing Market - Methodology

17.1. Research Methodology

17.1.1. Company Expert Interviews

17.1.2. Industry Databases

17.1.3. Associations

17.1.4. Company News

17.1.5. Company Annual Reports

17.1.6. Application Trends

17.1.7. New Products and Product database

17.1.8. Company Transcripts

17.1.9. R&D Trends

17.1.10. Key Opinion Leaders Interviews

17.1.11. Supply and Demand Trends

List of Tables

Table 1: Food Safety Testing Market Overview 2019-2024

Table 2: Food Safety Testing Market Leader Analysis 2018-2019 (US$)

Table 3: Food Safety Testing Market Product Analysis 2018-2019 (US$)

Table 4: Food Safety Testing Market End User Analysis 2018-2019 (US$)

Table 5: Food Safety Testing Market Patent Analysis 2013-2018* (US$)

Table 6: Food Safety Testing Market Financial Analysis 2018-2019 (US$)

Table 7: Food Safety Testing Market Driver Analysis 2018-2019 (US$)

Table 8: Food Safety Testing Market Challenges Analysis 2018-2019 (US$)

Table 9: Food Safety Testing Market Constraint Analysis 2018-2019 (US$)

Table 10: Food Safety Testing Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11: Food Safety Testing Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12: Food Safety Testing Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13: Food Safety Testing Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14: Food Safety Testing Market Degree of Competition Analysis 2018-2019 (US$)

Table 15: Food Safety Testing Market Value Chain Analysis 2018-2019 (US$)

Table 16: Food Safety Testing Market Pricing Analysis 2019-2024 (US$)

Table 17: Food Safety Testing Market Opportunities Analysis 2019-2024 (US$)

Table 18: Food Safety Testing Market Product Life Cycle Analysis 2019-2024 (US$)

Table 19: Food Safety Testing Market Supplier Analysis 2018-2019 (US$)

Table 20: Food Safety Testing Market Distributor Analysis 2018-2019 (US$)

Table 21: Food Safety Testing Market Trend Analysis 2018-2019 (US$)

Table 22: Food Safety Testing Market Size 2018 (US$)

Table 23: Food Safety Testing Market Forecast Analysis 2019-2024 (US$)

Table 24: Food Safety Testing Market Sales Forecast Analysis 2019-2024 (Units)

Table 25: Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 26: Food Safety Testing Market By Testing Type, Revenue & Volume, By Microbiology analysis, 2019-2024 ($)

Table 27: Food Safety Testing Market By Testing Type, Revenue & Volume, By Pathogens, 2019-2024 ($)

Table 28: Food Safety Testing Market By Testing Type, Revenue & Volume, By Pesticides & Fertilizers, 2019-2024 ($)

Table 29: Food Safety Testing Market By Testing Type, Revenue & Volume, By Allergen Analysis, 2019-2024 ($)

Table 30: Food Safety Testing Market By Testing Type, Revenue & Volume, By Lipids, Fats & Oil analysis, 2019-2024 ($)

Table 31: Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 32: Food Safety Testing Market By Testing Technology, Revenue & Volume, By Polymerase chain reaction, 2019-2024 ($)

Table 33: Food Safety Testing Market By Testing Technology, Revenue & Volume, By Nuclear Magnetic Resonance, 2019-2024 ($)

Table 34: Food Safety Testing Market By Testing Technology, Revenue & Volume, By Immunoassay, 2019-2024 ($)

Table 35: Food Safety Testing Market By Testing Technology, Revenue & Volume, By Enzyme Linked Immunosorbent Assay, 2019-2024 ($)

Table 36: Food Safety Testing Market By Testing Technology, Revenue & Volume, By Chromatography, 2019-2024 ($)

Table 37: Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 38: Food Safety Testing Market By End User, Revenue & Volume, By Dairy products, 2019-2024 ($)

Table 39: Food Safety Testing Market By End User, Revenue & Volume, By Grains, 2019-2024 ($)

Table 40: Food Safety Testing Market By End User, Revenue & Volume, By Processed foods, 2019-2024 ($)

Table 41: Food Safety Testing Market By End User, Revenue & Volume, By Meat & poultry, 2019-2024 ($)

Table 42: Food Safety Testing Market By End User, Revenue & Volume, By Fruits & vegeTable s, 2019-2024 ($)

Table 43: North America Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 44: North America Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 45: North America Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 46: South america Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 47: South america Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 48: South america Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 49: Europe Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 50: Europe Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 51: Europe Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 52: APAC Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 53: APAC Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 54: APAC Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 55: Middle East & Africa Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 56: Middle East & Africa Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 57: Middle East & Africa Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 58: Russia Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 59: Russia Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 60: Russia Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 61: Israel Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 62: Israel Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 63: Israel Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 64: Top Companies 2018 (US$)Food Safety Testing Market, Revenue & Volume

Table 65: Product Launch 2018-2019Food Safety Testing Market, Revenue & Volume

Table 66: Mergers & Acquistions 2018-2019Food Safety Testing Market, Revenue & Volume

List of Figures

Figure 1: Overview of Food Safety Testing Market 2019-2024

Figure 2: Market Share Analysis for Food Safety Testing Market 2018 (US$)

Figure 3: Product Comparison in Food Safety Testing Market 2018-2019 (US$)

Figure 4: End User Profile for Food Safety Testing Market 2018-2019 (US$)

Figure 5: Patent Application and Grant in Food Safety Testing Market 2013-2018* (US$)

Figure 6: Top 5 Companies Financial Analysis in Food Safety Testing Market 2018-2019 (US$)

Figure 7: Market Entry Strategy in Food Safety Testing Market 2018-2019

Figure 8: Ecosystem Analysis in Food Safety Testing Market 2018

Figure 9: Average Selling Price in Food Safety Testing Market 2019-2024

Figure 10: Top Opportunites in Food Safety Testing Market 2018-2019

Figure 11: Market Life Cycle Analysis in Food Safety Testing Market

Figure 12: GlobalBy Testing TypeFood Safety Testing Market Revenue, 2019-2024 ($)

Figure 13: GlobalBy Testing TechnologyFood Safety Testing Market Revenue, 2019-2024 ($)

Figure 14: GlobalBy End UserFood Safety Testing Market Revenue, 2019-2024 ($)

Figure 15: Global Food Safety Testing Market - By Geography

Figure 16: Global Food Safety Testing Market Value & Volume, By Geography, 2019-2024 ($)

Figure 17: Global Food Safety Testing Market CAGR, By Geography, 2019-2024 (%)

Figure 18: North America Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 19: US Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 20: US GDP and Population, 2018-2019 ($)

Figure 21: US GDP – Composition of 2018, By Sector of Origin

Figure 22: US Export and Import Value & Volume, 2018-2019 ($)

Figure 23: Canada Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 24: Canada GDP and Population, 2018-2019 ($)

Figure 25: Canada GDP – Composition of 2018, By Sector of Origin

Figure 26: Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 27: Mexico Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 28: Mexico GDP and Population, 2018-2019 ($)

Figure 29: Mexico GDP – Composition of 2018, By Sector of Origin

Figure 30: Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 31: South America Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 32: Brazil Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 33: Brazil GDP and Population, 2018-2019 ($)

Figure 34: Brazil GDP – Composition of 2018, By Sector of Origin

Figure 35: Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 36: Venezuela Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 37: Venezuela GDP and Population, 2018-2019 ($)

Figure 38: Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 39: Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 40: Argentina Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 41: Argentina GDP and Population, 2018-2019 ($)

Figure 42: Argentina GDP – Composition of 2018, By Sector of Origin

Figure 43: Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 44: Ecuador Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 45: Ecuador GDP and Population, 2018-2019 ($)

Figure 46: Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 47: Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 48: Peru Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 49: Peru GDP and Population, 2018-2019 ($)

Figure 50: Peru GDP – Composition of 2018, By Sector of Origin

Figure 51: Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 52: Colombia Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 53: Colombia GDP and Population, 2018-2019 ($)

Figure 54: Colombia GDP – Composition of 2018, By Sector of Origin

Figure 55: Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 56: Costa Rica Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 57: Costa Rica GDP and Population, 2018-2019 ($)

Figure 58: Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 59: Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 60: Europe Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 61: U.K Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 62: U.K GDP and Population, 2018-2019 ($)

Figure 63: U.K GDP – Composition of 2018, By Sector of Origin

Figure 64: U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 65: Germany Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 66: Germany GDP and Population, 2018-2019 ($)

Figure 67: Germany GDP – Composition of 2018, By Sector of Origin

Figure 68: Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 69: Italy Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 70: Italy GDP and Population, 2018-2019 ($)

Figure 71: Italy GDP – Composition of 2018, By Sector of Origin

Figure 72: Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 73: France Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 74: France GDP and Population, 2018-2019 ($)

Figure 75: France GDP – Composition of 2018, By Sector of Origin

Figure 76: France Export and Import Value & Volume, 2018-2019 ($)

Figure 77: Netherlands Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 78: Netherlands GDP and Population, 2018-2019 ($)

Figure 79: Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 80: Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 81: Belgium Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 82: Belgium GDP and Population, 2018-2019 ($)

Figure 83: Belgium GDP – Composition of 2018, By Sector of Origin

Figure 84: Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 85: Spain Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 86: Spain GDP and Population, 2018-2019 ($)

Figure 87: Spain GDP – Composition of 2018, By Sector of Origin

Figure 88: Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 89: Denmark Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 90: Denmark GDP and Population, 2018-2019 ($)

Figure 91: Denmark GDP – Composition of 2018, By Sector of Origin

Figure 92: Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 93: APAC Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 94: China Food Safety Testing Market Value & Volume, 2019-2024

Figure 95: China GDP and Population, 2018-2019 ($)

Figure 96: China GDP – Composition of 2018, By Sector of Origin

Figure 97: China Export and Import Value & Volume, 2018-2019 ($)Food Safety Testing Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 98: Australia Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 99: Australia GDP and Population, 2018-2019 ($)

Figure 100: Australia GDP – Composition of 2018, By Sector of Origin

Figure 101: Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 102: South Korea Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 103: South Korea GDP and Population, 2018-2019 ($)

Figure 104: South Korea GDP – Composition of 2018, By Sector of Origin

Figure 105: South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 106: India Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 107: India GDP and Population, 2018-2019 ($)

Figure 108: India GDP – Composition of 2018, By Sector of Origin

Figure 109: India Export and Import Value & Volume, 2018-2019 ($)

Figure 110: Taiwan Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 111: Taiwan GDP and Population, 2018-2019 ($)

Figure 112: Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 113: Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 114: Malaysia Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 115: Malaysia GDP and Population, 2018-2019 ($)

Figure 116: Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 117: Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 118: Hong Kong Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 119: Hong Kong GDP and Population, 2018-2019 ($)

Figure 120: Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 121: Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 122: Middle East & Africa Food Safety Testing Market Middle East & Africa 3D Printing Market Value & Volume, 2019-2024 ($)

Figure 123: Russia Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 124: Russia GDP and Population, 2018-2019 ($)

Figure 125: Russia GDP – Composition of 2018, By Sector of Origin

Figure 126: Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 127: Israel Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 128: Israel GDP and Population, 2018-2019 ($)

Figure 129: Israel GDP – Composition of 2018, By Sector of Origin

Figure 130: Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 131: Entropy Share, By Strategies, 2018-2019* (%)Food Safety Testing Market

Figure 132: Developments, 2018-2019*Food Safety Testing Market

Figure 133: Company 1 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 134: Company 1 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 135: Company 1 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 136: Company 2 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 137: Company 2 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 138: Company 2 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 139: Company 3 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 140: Company 3 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 141: Company 3 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 142: Company 4 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 143: Company 4 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 144: Company 4 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 145: Company 5 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 146: Company 5 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 147: Company 5 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 148: Company 6 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 149: Company 6 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 150: Company 6 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 151: Company 7 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 152: Company 7 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 153: Company 7 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 154: Company 8 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 155: Company 8 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 156: Company 8 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 157: Company 9 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 158: Company 9 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 159: Company 9 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 160: Company 10 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 161: Company 10 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 162: Company 10 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 163: Company 11 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 164: Company 11 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 165: Company 11 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 166: Company 12 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 167: Company 12 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 168: Company 12 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 169: Company 13 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 170: Company 13 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 171: Company 13 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 172: Company 14 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 173: Company 14 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 174: Company 14 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 175: Company 15 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 176: Company 15 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 177: Company 15 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Table 1: Food Safety Testing Market Overview 2019-2024

Table 2: Food Safety Testing Market Leader Analysis 2018-2019 (US$)

Table 3: Food Safety Testing Market Product Analysis 2018-2019 (US$)

Table 4: Food Safety Testing Market End User Analysis 2018-2019 (US$)

Table 5: Food Safety Testing Market Patent Analysis 2013-2018* (US$)

Table 6: Food Safety Testing Market Financial Analysis 2018-2019 (US$)

Table 7: Food Safety Testing Market Driver Analysis 2018-2019 (US$)

Table 8: Food Safety Testing Market Challenges Analysis 2018-2019 (US$)

Table 9: Food Safety Testing Market Constraint Analysis 2018-2019 (US$)

Table 10: Food Safety Testing Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11: Food Safety Testing Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12: Food Safety Testing Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13: Food Safety Testing Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14: Food Safety Testing Market Degree of Competition Analysis 2018-2019 (US$)

Table 15: Food Safety Testing Market Value Chain Analysis 2018-2019 (US$)

Table 16: Food Safety Testing Market Pricing Analysis 2019-2024 (US$)

Table 17: Food Safety Testing Market Opportunities Analysis 2019-2024 (US$)

Table 18: Food Safety Testing Market Product Life Cycle Analysis 2019-2024 (US$)

Table 19: Food Safety Testing Market Supplier Analysis 2018-2019 (US$)

Table 20: Food Safety Testing Market Distributor Analysis 2018-2019 (US$)

Table 21: Food Safety Testing Market Trend Analysis 2018-2019 (US$)

Table 22: Food Safety Testing Market Size 2018 (US$)

Table 23: Food Safety Testing Market Forecast Analysis 2019-2024 (US$)

Table 24: Food Safety Testing Market Sales Forecast Analysis 2019-2024 (Units)

Table 25: Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 26: Food Safety Testing Market By Testing Type, Revenue & Volume, By Microbiology analysis, 2019-2024 ($)

Table 27: Food Safety Testing Market By Testing Type, Revenue & Volume, By Pathogens, 2019-2024 ($)

Table 28: Food Safety Testing Market By Testing Type, Revenue & Volume, By Pesticides & Fertilizers, 2019-2024 ($)

Table 29: Food Safety Testing Market By Testing Type, Revenue & Volume, By Allergen Analysis, 2019-2024 ($)

Table 30: Food Safety Testing Market By Testing Type, Revenue & Volume, By Lipids, Fats & Oil analysis, 2019-2024 ($)

Table 31: Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 32: Food Safety Testing Market By Testing Technology, Revenue & Volume, By Polymerase chain reaction, 2019-2024 ($)

Table 33: Food Safety Testing Market By Testing Technology, Revenue & Volume, By Nuclear Magnetic Resonance, 2019-2024 ($)

Table 34: Food Safety Testing Market By Testing Technology, Revenue & Volume, By Immunoassay, 2019-2024 ($)

Table 35: Food Safety Testing Market By Testing Technology, Revenue & Volume, By Enzyme Linked Immunosorbent Assay, 2019-2024 ($)

Table 36: Food Safety Testing Market By Testing Technology, Revenue & Volume, By Chromatography, 2019-2024 ($)

Table 37: Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 38: Food Safety Testing Market By End User, Revenue & Volume, By Dairy products, 2019-2024 ($)

Table 39: Food Safety Testing Market By End User, Revenue & Volume, By Grains, 2019-2024 ($)

Table 40: Food Safety Testing Market By End User, Revenue & Volume, By Processed foods, 2019-2024 ($)

Table 41: Food Safety Testing Market By End User, Revenue & Volume, By Meat & poultry, 2019-2024 ($)

Table 42: Food Safety Testing Market By End User, Revenue & Volume, By Fruits & vegeTable s, 2019-2024 ($)

Table 43: North America Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 44: North America Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 45: North America Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 46: South america Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 47: South america Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 48: South america Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 49: Europe Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 50: Europe Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 51: Europe Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 52: APAC Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 53: APAC Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 54: APAC Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 55: Middle East & Africa Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 56: Middle East & Africa Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 57: Middle East & Africa Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 58: Russia Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 59: Russia Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 60: Russia Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 61: Israel Food Safety Testing Market, Revenue & Volume, By Testing Type, 2019-2024 ($)

Table 62: Israel Food Safety Testing Market, Revenue & Volume, By Testing Technology, 2019-2024 ($)

Table 63: Israel Food Safety Testing Market, Revenue & Volume, By End User, 2019-2024 ($)

Table 64: Top Companies 2018 (US$)Food Safety Testing Market, Revenue & Volume

Table 65: Product Launch 2018-2019Food Safety Testing Market, Revenue & Volume

Table 66: Mergers & Acquistions 2018-2019Food Safety Testing Market, Revenue & Volume

List of Figures

Figure 1: Overview of Food Safety Testing Market 2019-2024

Figure 2: Market Share Analysis for Food Safety Testing Market 2018 (US$)

Figure 3: Product Comparison in Food Safety Testing Market 2018-2019 (US$)

Figure 4: End User Profile for Food Safety Testing Market 2018-2019 (US$)

Figure 5: Patent Application and Grant in Food Safety Testing Market 2013-2018* (US$)

Figure 6: Top 5 Companies Financial Analysis in Food Safety Testing Market 2018-2019 (US$)

Figure 7: Market Entry Strategy in Food Safety Testing Market 2018-2019

Figure 8: Ecosystem Analysis in Food Safety Testing Market 2018

Figure 9: Average Selling Price in Food Safety Testing Market 2019-2024

Figure 10: Top Opportunites in Food Safety Testing Market 2018-2019

Figure 11: Market Life Cycle Analysis in Food Safety Testing Market

Figure 12: GlobalBy Testing TypeFood Safety Testing Market Revenue, 2019-2024 ($)

Figure 13: GlobalBy Testing TechnologyFood Safety Testing Market Revenue, 2019-2024 ($)

Figure 14: GlobalBy End UserFood Safety Testing Market Revenue, 2019-2024 ($)

Figure 15: Global Food Safety Testing Market - By Geography

Figure 16: Global Food Safety Testing Market Value & Volume, By Geography, 2019-2024 ($)

Figure 17: Global Food Safety Testing Market CAGR, By Geography, 2019-2024 (%)

Figure 18: North America Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 19: US Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 20: US GDP and Population, 2018-2019 ($)

Figure 21: US GDP – Composition of 2018, By Sector of Origin

Figure 22: US Export and Import Value & Volume, 2018-2019 ($)

Figure 23: Canada Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 24: Canada GDP and Population, 2018-2019 ($)

Figure 25: Canada GDP – Composition of 2018, By Sector of Origin

Figure 26: Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 27: Mexico Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 28: Mexico GDP and Population, 2018-2019 ($)

Figure 29: Mexico GDP – Composition of 2018, By Sector of Origin

Figure 30: Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 31: South America Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 32: Brazil Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 33: Brazil GDP and Population, 2018-2019 ($)

Figure 34: Brazil GDP – Composition of 2018, By Sector of Origin

Figure 35: Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 36: Venezuela Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 37: Venezuela GDP and Population, 2018-2019 ($)

Figure 38: Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 39: Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 40: Argentina Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 41: Argentina GDP and Population, 2018-2019 ($)

Figure 42: Argentina GDP – Composition of 2018, By Sector of Origin

Figure 43: Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 44: Ecuador Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 45: Ecuador GDP and Population, 2018-2019 ($)

Figure 46: Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 47: Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 48: Peru Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 49: Peru GDP and Population, 2018-2019 ($)

Figure 50: Peru GDP – Composition of 2018, By Sector of Origin

Figure 51: Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 52: Colombia Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 53: Colombia GDP and Population, 2018-2019 ($)

Figure 54: Colombia GDP – Composition of 2018, By Sector of Origin

Figure 55: Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 56: Costa Rica Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 57: Costa Rica GDP and Population, 2018-2019 ($)

Figure 58: Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 59: Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 60: Europe Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 61: U.K Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 62: U.K GDP and Population, 2018-2019 ($)

Figure 63: U.K GDP – Composition of 2018, By Sector of Origin

Figure 64: U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 65: Germany Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 66: Germany GDP and Population, 2018-2019 ($)

Figure 67: Germany GDP – Composition of 2018, By Sector of Origin

Figure 68: Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 69: Italy Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 70: Italy GDP and Population, 2018-2019 ($)

Figure 71: Italy GDP – Composition of 2018, By Sector of Origin

Figure 72: Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 73: France Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 74: France GDP and Population, 2018-2019 ($)

Figure 75: France GDP – Composition of 2018, By Sector of Origin

Figure 76: France Export and Import Value & Volume, 2018-2019 ($)

Figure 77: Netherlands Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 78: Netherlands GDP and Population, 2018-2019 ($)

Figure 79: Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 80: Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 81: Belgium Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 82: Belgium GDP and Population, 2018-2019 ($)

Figure 83: Belgium GDP – Composition of 2018, By Sector of Origin

Figure 84: Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 85: Spain Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 86: Spain GDP and Population, 2018-2019 ($)

Figure 87: Spain GDP – Composition of 2018, By Sector of Origin

Figure 88: Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 89: Denmark Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 90: Denmark GDP and Population, 2018-2019 ($)

Figure 91: Denmark GDP – Composition of 2018, By Sector of Origin

Figure 92: Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 93: APAC Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 94: China Food Safety Testing Market Value & Volume, 2019-2024

Figure 95: China GDP and Population, 2018-2019 ($)

Figure 96: China GDP – Composition of 2018, By Sector of Origin

Figure 97: China Export and Import Value & Volume, 2018-2019 ($)Food Safety Testing Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 98: Australia Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 99: Australia GDP and Population, 2018-2019 ($)

Figure 100: Australia GDP – Composition of 2018, By Sector of Origin

Figure 101: Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 102: South Korea Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 103: South Korea GDP and Population, 2018-2019 ($)

Figure 104: South Korea GDP – Composition of 2018, By Sector of Origin

Figure 105: South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 106: India Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 107: India GDP and Population, 2018-2019 ($)

Figure 108: India GDP – Composition of 2018, By Sector of Origin

Figure 109: India Export and Import Value & Volume, 2018-2019 ($)

Figure 110: Taiwan Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 111: Taiwan GDP and Population, 2018-2019 ($)

Figure 112: Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 113: Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 114: Malaysia Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 115: Malaysia GDP and Population, 2018-2019 ($)

Figure 116: Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 117: Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 118: Hong Kong Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 119: Hong Kong GDP and Population, 2018-2019 ($)

Figure 120: Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 121: Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 122: Middle East & Africa Food Safety Testing Market Middle East & Africa 3D Printing Market Value & Volume, 2019-2024 ($)

Figure 123: Russia Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 124: Russia GDP and Population, 2018-2019 ($)

Figure 125: Russia GDP – Composition of 2018, By Sector of Origin

Figure 126: Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 127: Israel Food Safety Testing Market Value & Volume, 2019-2024 ($)

Figure 128: Israel GDP and Population, 2018-2019 ($)

Figure 129: Israel GDP – Composition of 2018, By Sector of Origin

Figure 130: Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 131: Entropy Share, By Strategies, 2018-2019* (%)Food Safety Testing Market

Figure 132: Developments, 2018-2019*Food Safety Testing Market

Figure 133: Company 1 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 134: Company 1 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 135: Company 1 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 136: Company 2 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 137: Company 2 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 138: Company 2 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 139: Company 3 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 140: Company 3 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 141: Company 3 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 142: Company 4 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 143: Company 4 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 144: Company 4 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 145: Company 5 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 146: Company 5 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 147: Company 5 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 148: Company 6 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 149: Company 6 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 150: Company 6 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 151: Company 7 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 152: Company 7 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 153: Company 7 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 154: Company 8 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 155: Company 8 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 156: Company 8 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 157: Company 9 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 158: Company 9 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 159: Company 9 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 160: Company 10 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 161: Company 10 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 162: Company 10 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 163: Company 11 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 164: Company 11 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 165: Company 11 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 166: Company 12 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 167: Company 12 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 168: Company 12 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 169: Company 13 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 170: Company 13 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 171: Company 13 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 172: Company 14 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 173: Company 14 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 174: Company 14 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

Figure 175: Company 15 Food Safety Testing Market Net Revenue, By Years, 2018-2019* ($)

Figure 176: Company 15 Food Safety Testing Market Net Revenue Share, By Business segments, 2018 (%)

Figure 177: Company 15 Food Safety Testing Market Net Sales Share, By Geography, 2018 (%)

이메일

이메일 인쇄

인쇄